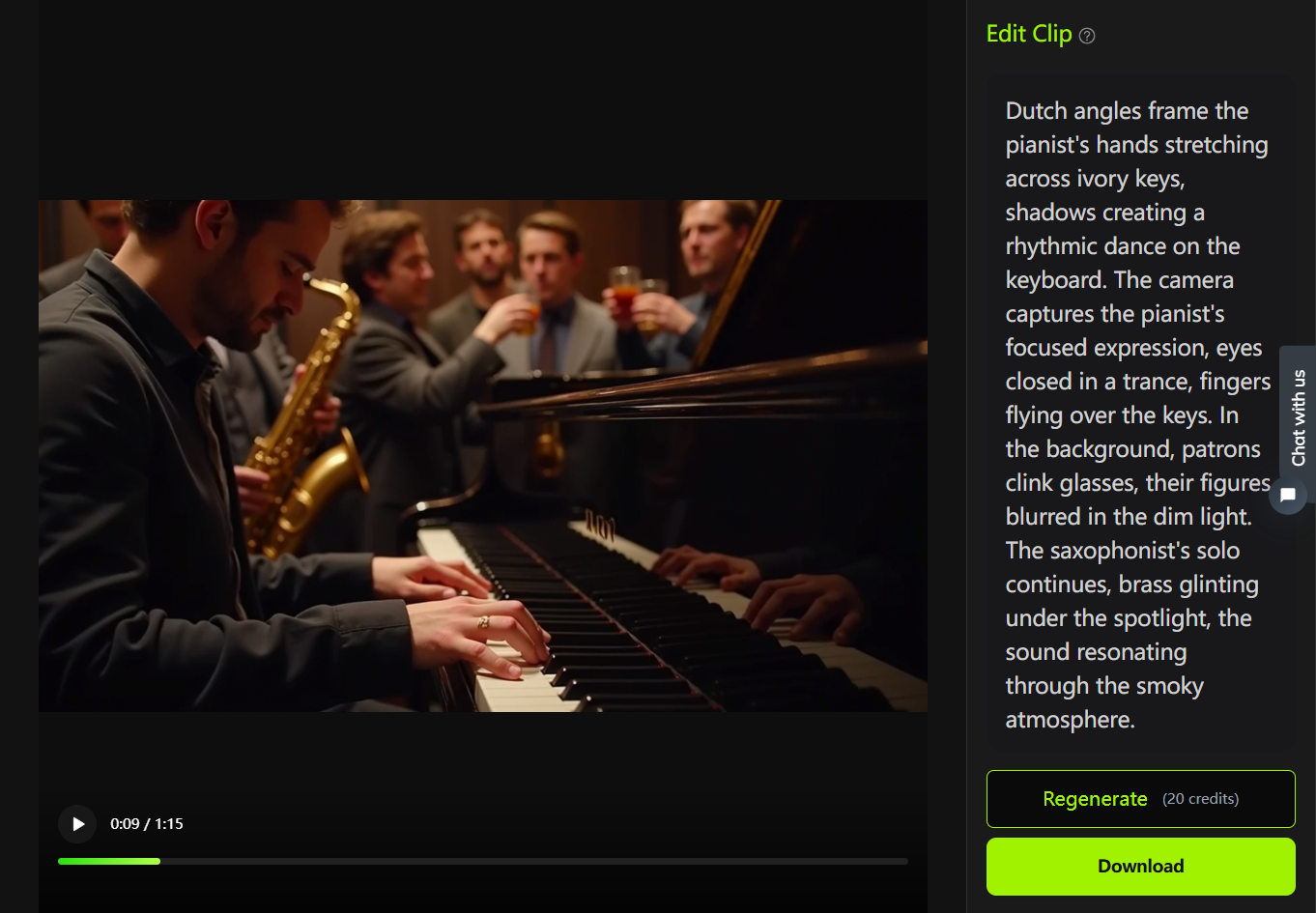

Refinance Calculator Powered by A.I. - AI-Powered Mortgage Refinance

Welcome! Let's calculate your refinance savings.

Optimize your mortgage with AI precision.

Enter your current mortgage balance to begin the calculation.

What is your current interest rate?

Please provide the remaining term of your current mortgage.

What is the new interest rate for the refinance?

Get Embed Code

Overview of Refinance Calculator Powered by A.I.

Refinance Calculator Powered by A.I. is designed to assist users in evaluating the potential benefits and implications of refinancing their mortgage. By inputting specific details such as current mortgage balance, interest rates, terms, and potential new loan conditions, users can obtain a clear, personalized analysis of how refinancing might affect their financial situation. This tool leverages algorithmic calculations to provide insights into monthly savings, new payment structures, and overall cost or savings over the life of the loan. For example, a homeowner considering refinancing to take advantage of lower interest rates can use this tool to compare their current mortgage terms against proposed new terms, factoring in closing costs to determine net savings. Powered by ChatGPT-4o。

Core Functions of Refinance Calculator Powered by A.I.

Monthly Payment Estimation

Example

Calculating new monthly payments after refinancing to a lower interest rate.

Scenario

A homeowner with an existing mortgage of $250,000 at 4.5% interest looks to refinance at 3.5%. The tool estimates new monthly payments, highlighting potential savings.

Break-even Point Analysis

Example

Determining the time required to recoup closing costs through refinancing savings.

Scenario

The calculator analyzes when the monthly savings from refinancing will cover the upfront closing costs, aiding homeowners in decision-making about the timing of their refinance.

Total Interest and Cost Comparison

Example

Comparing total interest and costs between current and new loan terms.

Scenario

It provides a side-by-side comparison of the total interest and costs paid over the life of the original mortgage versus the refinanced loan, helping users understand long-term financial impacts.

Target User Groups for Refinance Calculator Powered by A.I.

Homeowners Considering Refinancing

Individuals looking to lower their monthly mortgage payments, change their loan terms, or tap into home equity for large expenses. This tool helps them evaluate if refinancing is a financially viable option.

Financial Advisors

Professionals advising clients on mortgage management and personal finance strategies. They use the calculator to provide data-driven recommendations tailored to their clients' specific situations.

How to Use Refinance Calculator Powered by A.I.

Begin Your Experience

Start by accessing a platform offering a seamless experience without the need for a login or a premium subscription.

Enter Your Loan Information

Provide details about your current mortgage including balance, interest rate, and remaining term.

Specify Refinance Details

Input the desired new interest rate and term for the refinanced mortgage, along with any applicable closing costs.

Review Your Calculation

Submit the information to receive a detailed breakdown of your potential savings, new monthly payment, and break-even point.

Optimize Your Refinance

Use the insights to adjust variables and explore different refinancing options to maximize your financial benefits.

Try other advanced and practical GPTs

PromptMaster Pro

Enhancing AI Responses with Precision

神様図鑑

Unveiling the Divine: AI-Powered Insights into Japanese Deities

Hollow Lore Guide

Unlock the secrets of Hollow Knight lore.

Sales Mastery with Matt

Elevate Your Sales Game with AI

PromptCraft AI

Crafting Your Ideas with AI Precision

Employee Resignation Letter - Custom GPT Prompt

Crafting Your Goodbye, Professionally Powered by AI

QT2 CRA - Exercise Physiology Explainer

Unlock Exercise Science with AI-Powered Precision

Menace meaning?

Empowering Insights with AI Precision

InspireEmpower

Empowering minds, inspiring lives with AI.

FD Fixed Deposit Rate Calculator Powered by A.I.

Maximize savings with AI-powered precision

Vitalik Bot-erin Ethereum Dev - by dAppGPT.ai -

AI-powered Ethereum development companion

Academic Reference Letter Writer Free GPT

Tailor-made academic letters, powered by AI

Refinance Calculator Powered by A.I. FAQs

What information do I need to use the Refinance Calculator?

You'll need your current mortgage balance, interest rate, remaining term, desired new interest rate and term for refinancing, and any closing costs.

Can the Refinance Calculator help me decide between different terms?

Yes, the calculator allows you to input various terms and interest rates to compare the outcomes and decide which refinancing option best suits your needs.

Does the calculator take closing costs into account?

Absolutely, it includes closing costs in the calculation to provide a comprehensive view of your refinancing options and the true cost of refinancing.

How accurate is the Refinance Calculator?

While highly accurate, the calculator provides estimates based on the information you provide. For precise figures, consult with a financial advisor.

Can I use this tool for an investment property refinance?

Yes, the Refinance Calculator is versatile and can be used for both primary residences and investment properties.