SEC Disclosures Analyst - SEC filing analysis tool

Hello, ready to dive into financial analysis?

Analyzing SEC data with AI precision

Interpret the key figures in XYZ Corp's 10-Q.

What are the risks in ABC Inc's latest 10-K?

How does the Form 4 filing affect the insider's position?

Generate a chart showing XYZ Corp's financial trend.

Get Embed Code

Overview of SEC Disclosures Analyst

SEC Disclosures Analyst is designed to analyze Securities and Exchange Commission (SEC) filings, including forms like 10-K, 10-Q, Form 4, and Schedule 13D, to provide insights into financial trends and insider transactions. The core purpose is to assist users in understanding the financial health and equity transaction patterns of publicly traded companies through meticulous examination of public disclosures. For instance, it can highlight significant changes in insider ownership through analysis of Form 4 filings, identifying potential dilutive events and their implications for equity value. Powered by ChatGPT-4o。

Key Functions of SEC Disclosures Analyst

Analysis of SEC Filings

Example

Extracting data from a 10-K form to analyze year-over-year changes in revenue, liabilities, and operational costs.

Scenario

A financial analyst uses this function to assess the financial stability and growth trends of a company over the fiscal year.

Insider Transaction Tracking

Example

Monitoring Form 4 filings to chart the buying and selling activities of company insiders, highlighting the impact on stock dilution.

Scenario

An investment firm uses this information to make informed decisions about the timing and context of these insider trades.

Trend Identification in Financial Metrics

Example

Identifying trends in EBITDA margins or debt levels from quarterly 10-Q reports.

Scenario

A portfolio manager tracks these trends to evaluate the company’s operational efficiency and financial risk.

Target User Groups for SEC Disclosures Analyst

Financial Analysts

Professionals who analyze financial statements, equity value, and market trends to make investment recommendations. They benefit from detailed, timely data on insider transactions and comprehensive financial overviews.

Investment Firms

Firms that require in-depth analysis of financial disclosures to guide investment strategies, manage portfolios, and monitor corporate governance issues. They rely on systematic tracking of insider transactions and financial performance metrics.

Regulatory Compliance Officers

Officers who ensure that financial practices comply with regulatory standards. They use insights from SEC filings to monitor corporate actions and ensure transparency in disclosures.

How to Use SEC Disclosures Analyst

1

Start by visiting yeschat.ai for a free trial, no login required, and no need for a ChatGPT Plus subscription.

2

Familiarize yourself with the main functions by exploring the tool's dashboard which provides options for analyzing SEC filings such as 10-K, 10-Q, and Form 4.

3

Input a company name or ticker symbol to retrieve the latest SEC filings and related financial analysis, focusing particularly on insider transactions and trends.

4

Use the graphical representations to visualize trends in insider trading, highlighting any potentially dilutive transactions affecting equity value.

5

Regularly update your searches to monitor new filings and changes, enabling you to track company and insider activities over time effectively.

Try other advanced and practical GPTs

D-Link DIR-2150 AC2100 GPT

Smart, Simple, Secure Networking

Personal Reel Guide

Craft Compelling Coding Stories

Business Blueprinter

Streamlining Strategy with AI

Steve Jobs

Harness the Mind of a Visionary

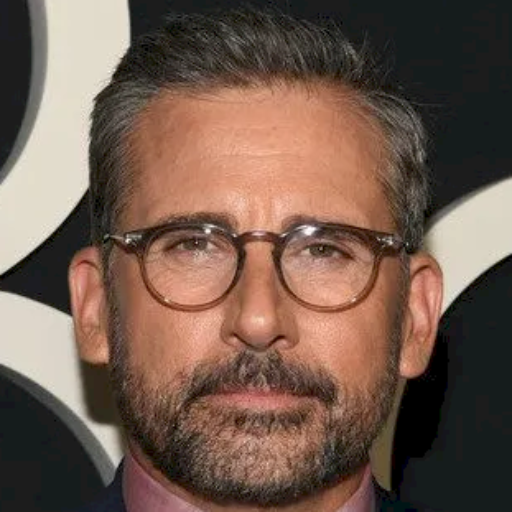

Steve Carell

Empower your conversations with AI-powered persona simulation.

Steve Jobs

Channeling Steve Jobs' Vision

IFRS Advisor

Streamlining IFRS Compliance with AI

Obesity

Empowering health with AI-driven insights

OBESITY GUIDE

Powering Your Path to Healthier Living

Meta Trader 5 Trading Bot Builder

Empower Your Trades with AI

Enduring Wisdom

Guidance for your personal journey.

UE5 Blueprint Expert

Empowering Your Game Development with AI

Frequently Asked Questions about SEC Disclosures Analyst

What SEC filings can SEC Disclosures Analyst analyze?

SEC Disclosures Analyst can analyze a variety of SEC filings including 10-K reports, 10-Q reports, Form 4 (insider trading reports), and Schedule 13D among others.

How does the tool help in understanding insider transactions?

The tool provides detailed visualizations of insider transactions, highlighting trends and identifying transactions that could potentially dilute shareholder equity, thus offering valuable insights into insider behavior.

Can I track historical data for a company using SEC Disclosures Analyst?

Yes, you can track historical SEC filings and insider transaction data, which allows for a comprehensive understanding of financial trends and behaviors over time.

Is this tool suitable for academic research?

Absolutely, academic researchers can use SEC Disclosures Analyst to gather and analyze data for studies focused on corporate governance, financial trends, and market behavior.

What is the main advantage of using SEC Disclosures Analyst over other financial tools?

Its ability to parse and visualize complex financial data specifically from SEC filings makes it highly beneficial for detailed financial analysis, especially concerning equity dilution and insider trading patterns.